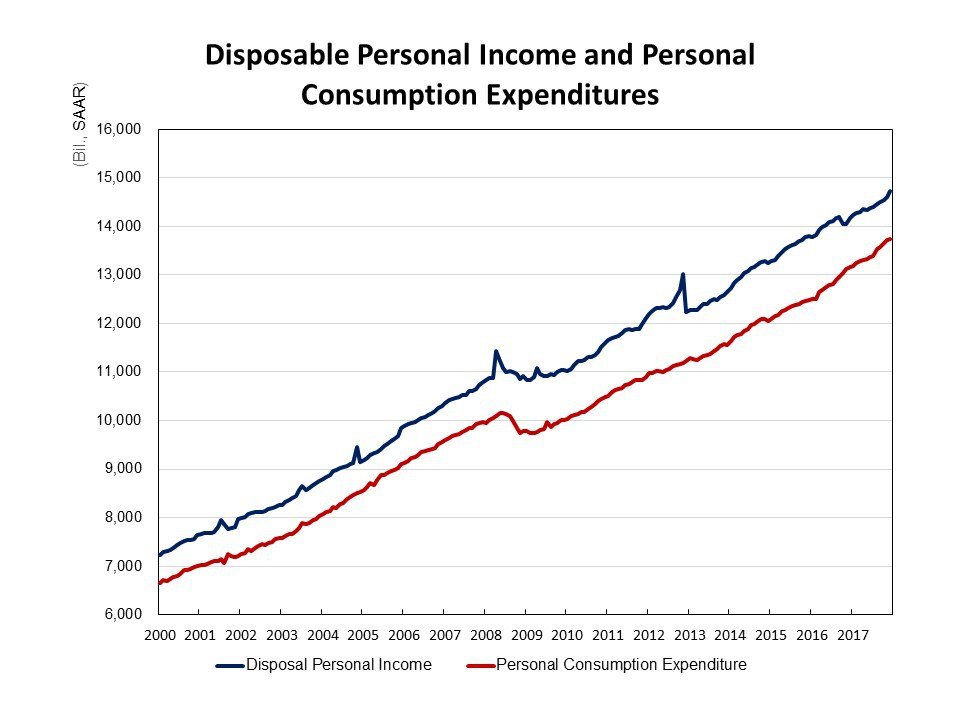

Real disposable income, income after adjusted for taxes and inflation, increased 0.6% in January after a 0.2% rise in the prior month. This is the biggest increase since April 2015, as tax reform related bonuses helped income growth in January. According to the most recent data release from the Bureau of Economic Analysis, personal income was up by 0.4% in January after the same percentage increase in the prior month.

Personal consumption expenditures (PCE) edged up 0.2% in January. After accounting for inflation, real PCE declined 0.1%, the first decline in a year. Spending slowed slightly in January, followed by a solid growth in the last holiday seasons. On a year-over-year comparison, personal consumption increased 2.7% in January.

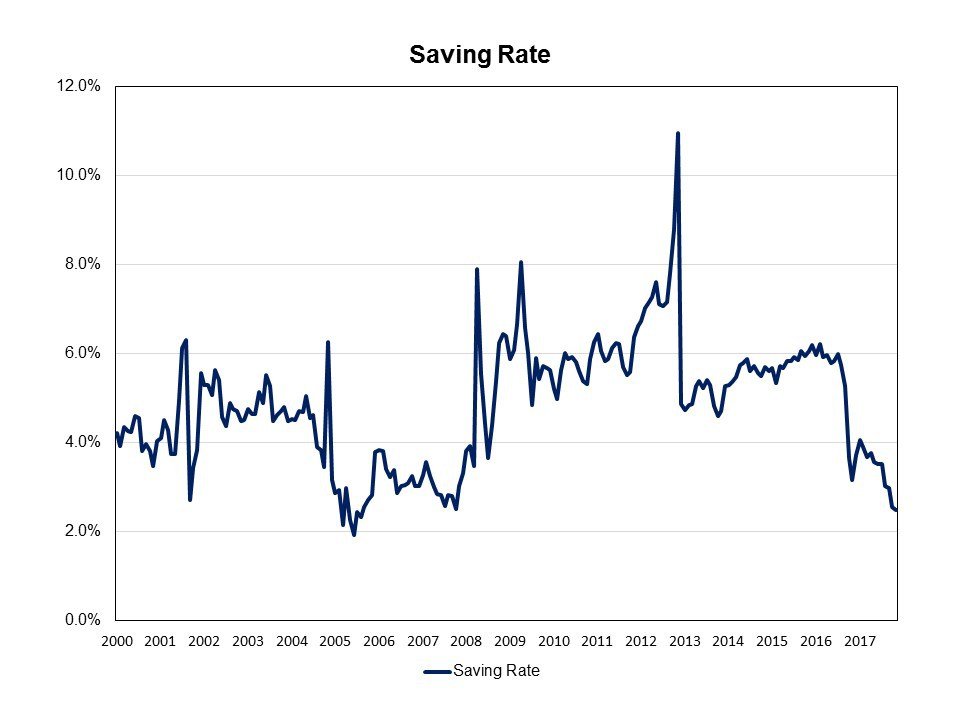

In January, savings increased to $464 billion from $363 billion in December. The savings rate rose to 3.2% after a relatively low 2.5% in December, as income gains outpaced consumer spending. As shown in the graph below, the savings rate has been on the downward path since 2016 when rising consumption contributed to fueling economic growth.

Source: NAHB Eye on Housing